Contents:

Let’s say that his county’s high school needs to have asbestos removed from the building. But they can’t remove it during the school year, so they decide the removal will happen in July. They know in January or February that they need $330,000 in July’s budget. It hasn’t been spent yet, but it’s been reserved for the asbestos removal, so it’s an encumbrance. He calculates how much money he’s earning and then subtracts how much money he’s spending.

OneSavingsBank plc – 2022 Annual Report and Accounts – GlobeNewswire

OneSavingsBank plc – 2022 Annual Report and Accounts.

Posted: Fri, 31 Mar 2023 06:05:00 GMT [source]

We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with Planergy. Encumbrance accounting has three main phases, in line with those for procuring goods or services. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. In fact, this card is so good that our experts even use it personally.

To enter an encumbrance batch:

You can remember that because, when you pronounce the word ”expenditure,” the word ”spend” is right there in the middle of it. So whether it’s repairs to the local roads, money going to the school district, or some other expense, it goes into the expenditures side. To help Khalid deal with his county’s budget, let’s take a closer look at encumbrances in government budgeting, including what they are and the formula to determine how much money a government has available.

- The companies track and analyze differences as favorable and unfavorable variances.

- Now finalized numbers are in place, and there is a legal obligation to make the payment.

- Accounting sometimes will track these requests in the general ledger.

- Let’s say that his county’s high school needs to have asbestos removed from the building.

- You may view a budget’s total amount of encumbrances in Grant Tracker.

You can execute year-end carry forward a number of times for different ranges of accounts and different encumbrance types. Because Carry Forward does not create journal entries, the balances brought forward cannot be reversed. When you carry forward year-end encumbrances, the Carry Forward rule you specify determines the amounts to be carried forward. Note that General Ledger carries forward balances, not as period activity, but as beginning balances. In addition to using these reports to identify outstanding encumbrances, request these reports before year-end carry-forward to create an audit trail of encumbrance balances. Before entering encumbrances manually, organize them into batches.

Using segments enables you to easily track the expenses against any temporarily restricted donation, allowing donors and foundations the ability to see exactly how their funds were used. For instance, a nonprofit organization may receive a donation in the amount of $5,000 that the donor states must be used to pay for a particular program before the end of the year. Grants are also considered temporarily restricted as they also have an expiration date. If you’re still unsure what fund accounting is, we’ve provided you with the basics you need for your nonprofit organization. Encumbrances are for internal planning and monitoring only and will NOT be reflected on invoices or reports to the sponsor.

What is an Encumbrance?

If you are using the Encumbrances Only rule or the Encumbrances and Encumbered Budget rule, enter the Encumbrance Type you want to carry forward. Carry Forward rules 2 and 3 can be combined if you want to carry forward budget amounts equal to encumbrances plus funds available. Note that when combining these Carry Forward rules, they must be run consecutively in a specific order. First run Carry Forward rule 3, Funds Available, then rule 2, Encumbrances and Encumbered Budget.

An example of a pre-encumbrance transaction is a purchase requisition. Typically, there are two ways of using encumbrances to monitor overspending. One way is to look for over-expenditures in reports generated after posting actuals and encumbrances. The other is to identify potential over-expenditures before they occur by verifying whether the budget has sufficient funds to cover the actual and hidden costs. In encumbrance accounting, that number is upfront and easy for any budgeting committee or CFO to examine.

Internal Ecumbrances represent the commitment of funds generated by travel authorization documents and are coded with the balance type code IE. Commitment of funds generated by purchase orders are recorded using the EX balance type. After the vendor accepts the purchase order and delivers the goods or services, the purchasing organization becomes liable to make the payment. If you’re selling kites or providing consulting services, it’s likely that your customers care little about how you spend your money. If you accept money from the general public or granting organizations, you need to provide details on how that money is used.

Category 2: Temporarily restricted

The breakdown by account code can be found in MyFinancial.desktop under the Current Encumbrances report. Encumbrance and open balance information is based on data from Workday and Ariba. You can review funds available and compare encumbrances and expenditures with budgets. You can review primary ledger currency budget, actual and encumbrance balances, and funds available for any detail or summary account. General Ledger calculates funds available by subtracting expenditures and encumbrances from budgets.

Large Italian Banks’ Liquidity and Funding Resilient due to Stable … – Fitch Ratings

Large Italian Banks’ Liquidity and Funding Resilient due to Stable ….

Posted: Thu, 13 Apr 2023 09:35:00 GMT [source]

Contract and Grant Cost Share Encumbrances are created for purchase orders that are cost-share funded and coded with balance type code CE. The External Encumbrance refers to the commitment of funds generated by purchase orders. Internal Encumbrances represent the commitment of funds generated by a Travel Authorization document. In Balance Reports, encumbrances can be toggled on or off to reflect available balances. Report users can use this encumbrance indicator to evaluate their available balances and solvency concerns, at budget or fiscal year end.

Drafting a Pre-Encumbrance

In the future, when you pay that sum off, the encumbrance account is credited. The accounting term encumbrance can sometimes be mistaken for real estate encumbrance. When a real estate property has a lien or easement, it is considered encumbered. The real estate term has nothing to do with encumbrance entries in accounting. Once the encumbrance is approved, the funds are no longer available for use in other transactions. Any encumbrance funds are not part of the actual funds ledger balance, because payments haven’t been processed.

For some companies, using a payment aggregator simplifies the digital payment process significantly, though the method may not be for everyone. A judgment lien is a court ruling giving a creditor the right to take possession of a debtor’s property if the debtor doesn’t fulfill their obligations. A lease is an agreement to rent a property for an agreed-upon rate and period of time.

bookkeeping services accounting has many benefits for a company, including better visibility, improved expenditure control, and more precise analysis. This type of accounting also helps detect fraud, prevent rampant spending, and increases budget control. A tax lien is a lien imposed by a government to force the payment of taxes; in the U.S., a federal tax lien trumps all other claims on a debtor’s assets.

The available amount for the second month of the quarter is $200.Year-to-Date ExtendedCalculates funds available as the budgeted amount to date for the year, less actuals and encumbrances to date for the year. For example, you budget $100 to an account for each of the 12 months. For example, if you budget $100 for January, spend $50 and have $10 in encumbrances, the funds available for January is $40. If you view funds available for the amount type PTD for February, the February balances will not include the $40 available at the end of January.

An Introduction to Encumbrance Accounting & The Encumbrance Process

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Click here to read our full review for free and apply in just 2 minutes. Encumbrance accounting is independent from Budgetary Control and is managed by these application. A basic financial statement or required supplementary information. With this equation, Khalid can put the money for the asbestos removal into the budget before it’s spent. That will make sure that the money isn’t spent on anything else and will give him a more complete view of the money available in the budget. Choose Carry Forward to initiate the carry forward process and to print an audit report.

It is up to departments to include their encumbrance transactions in their projected expense planning , and adjust their actual expense planning based on expected budget vs. expected Actuals. Government budgeting is the process whereby a local, state, or federal government plans and spends money. It’s similar to–but not exactly like–when people or private companies create budgets for themselves.

When you make the PO, you then will generate an entry indicating the encumbrance or the money you will pay in the future for that order. Once you pay that supplier’s invoice, you will remove that money from within the encumbrance balance. The lender, generally a bank, retains an interest in the title to a house until the mortgage is paid off. If the borrower cannot repay the mortgage, the lender may foreclose, seizing the house as collateral and evicting the inhabitants. The term is used in accounting to refer to restricted funds inside an account that are reserved for a specific liability. Pre-encumbrances allow departments to further commit funds to facilitate financial management and are coded with balance type code PE.

Improved planning

Encumbrance when it comes to real estate, due to its many applications, has many different types. Each type is meant to both protect parties and specify exactly what each claim entails—and is entitled to. In this document, the IT department can list the equipment they want to purchase and the vendor they intend to use. It’s then automatically sent to the department head and anyone else who must approve the purchase based on the approval workflow rules and thresholds that have been set up in the Planergy system. If for example, the IT department seeks to purchase $30,000 in new computer equipment, someone in the department will make a pre-encumbrance request to approve the purchase. If management approves, the IT department writes the purchase order, which creates the encumbrance.

Financial managers can use the following reports to analyze their encumbrances. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

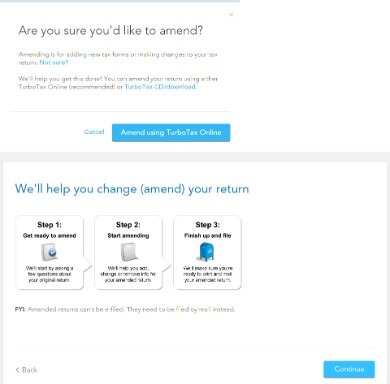

Once both the purchase requisition and the vendor approve the pricing and order details, the pre-encumbrance phase evolves into the encumbrance phase. Now finalized numbers are in place, and there is a legal obligation to make the payment. This phase is recorded in the general ledger when using encumbrance accounting, even if you did not use the pre-encumbrance stage. The first step is to encumber the new items to the general ledger. The main currency used by the organization to conduct its operations is used when encumbering the items. In the second step, the items are unencumbered once they’ve been transferred to accounts payable.

We recommend that you let the Posting program automatically reserve funds. Since reserving funds for encumbrance entries independent of budgetary control is always successful, this method requires no user intervention. Your data access set must provide full read and write access to your ledger, or read and write access to all balancing segment values or management segment values to open the encumbrance year for the ledger. With General Ledger you can record pre-expenditures commonly known as encumbrances. The primary purpose of tracking encumbrances is to avoid overspending a budget. Encumbrances can also be used to predict cash outflow and as a general planning tool.